GUIDE: Evaluating Outsourced vs. In-House Accounting for Your Business’s Unique Needs

Your business is scaling, and the financial decisions are getting more complex. You know your current setup isn’t cutting it anymore – but what’s the best next move?

Should you build an in-house accounting team or outsource to a specialized firm?

There’s no one-size-fits-all answer. But understanding the key differences, costs, and trade-offs can help you make a confident decision that aligns with your business’s unique needs, goals, and growth stage.

The Real Question: What Kind of Accounting Support Does Your Business Actually Need?

Not all accounting is created equal. Depending on your revenue, industry, and complexity, you might need some combination of:

- Systems integration and configuration

- Accounting

- Inventory and/or ecommerce management

- Time accounting

- AP, expense, and credit card management

- Data curation

- Technical accounting

- Revenue recognition (ASC 606)

- Lease accounting (ASC 842)

- Acquisition integration

- Policy and process creation and oversight

- Cash flow forecasting

- Audit prep and tax planning

- Compliance and/or covenant reporting

As you grow past $2M in annual revenue, managing this complexity with a single internal hire (or worse, doing it yourself) can expose your business to risk and missed opportunity.

Option 1: Building an In-House Accounting Function

Pros:

- Control & proximity: Your team is fully dedicated to your business from a time and mindshare perspective

- Culture alignment: In-house staff integrate deeply into your ops and participate fully in your company culture.

- Leadership: If you hire a senior in-house finance person, they can manage organizational change and alignment if required for your stage of growth

Cons:

- Cost: Hiring a controller or CFO adds significant payroll overhead (plus benefits, tools, training, etc.).

- Continuity: One hire means one point of failure… What happens when they’re out, leave, or fall behind?

- Recruiting burden: Finding qualified accounting talent takes time and skill you might not have in-house.

Best fit for: Larger companies (starting between $30M and $50M in annual revenue) with complex operations and the resources to build and manage a multi-role finance department.

Option 2: Partnering with an Outsourced Accounting Team

Pros:

- Cost-effective access to expertise: Get controller-level oversight, staff-level execution, and CFO-level strategy without paying three-plus full-time salaries.

- Scalable & flexible: Your support grows (or shrinks) with your needs.

- Systems + process baked in: A good fractional accounting team brings proven frameworks, industry knowledge, and the right tech stack.

Cons:

- Less role-flexibility: If you want your accounting team to cover non-accounting tasks that an internal person may have done (e.g. answer the main phone number, or take cash to the local bank), it may not make sense.

Best fit for: Growing businesses ($2M–$30M) who need sophisticated financial management but aren’t ready to build a full team from scratch.

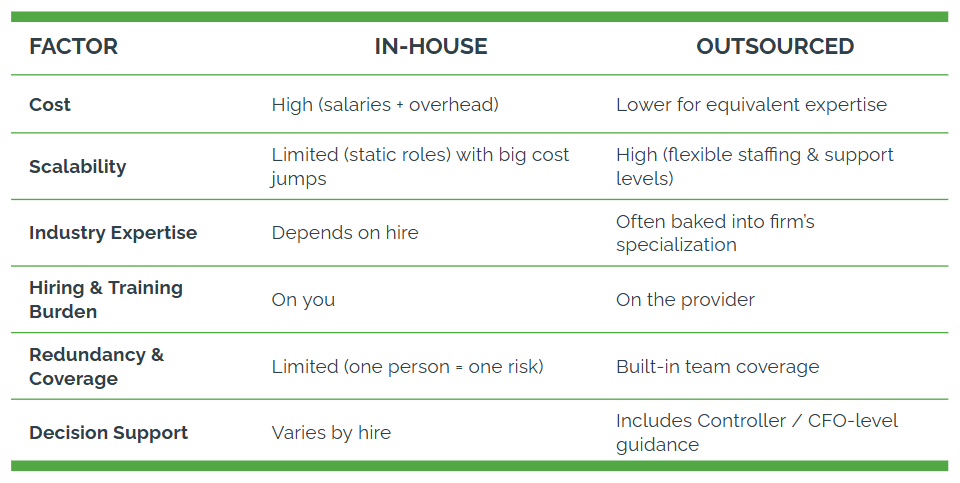

Key Factors to Evaluate for Your Business

What the Right Partner (or Hire) Should Deliver

Whether in-house or an outsourced accounting team, the finance function of your business should:

- Deliver clear, accurate and on-time monthly financials

- Provide actionable insights – not just reports

- Help you forecast cash, manage risk, and plan for growth

- Be proactive – not reactive

If you’re not getting these outcomes, the problem isn’t just who’s doing your accounting… It’s how your accounting is structured.

Still Not Sure What’s Right for You?

Let’s talk. Schedule a Free Assessment (no pressure or strings attached) and we’ll help you evaluate your current setup, identify your true needs, and determine whether outsourced or in-house is the right next step for your business.

James Wheeler

https://www.linkedin.com/in/jamesdavidwheeler/James Wheeler is a fractional CFO and the founder of kept.pro, which provides a proven outsourced accounting department model for growing companies with $2M–$50M in annual revenue. He brings 15+ years of executive finance leadership across services and technology businesses and was twice a finalist for the San Diego Business Journal’s CFO of the Year. James holds a BA in Economics and an MBA from UC San Diego, completed executive education at MIT Sloan, and has served on nonprofit and for-profit boards.